Understanding FHA Loan Charges: Your Comprehensive Guide to Affordable Home Financing

Guide or Summary:What Are FHA Loan Charges?Why Understanding FHA Loan Charges Is ImportantHow to Minimize FHA Loan ChargesWhen it comes to securing a mortga……

Guide or Summary:

- What Are FHA Loan Charges?

- Why Understanding FHA Loan Charges Is Important

- How to Minimize FHA Loan Charges

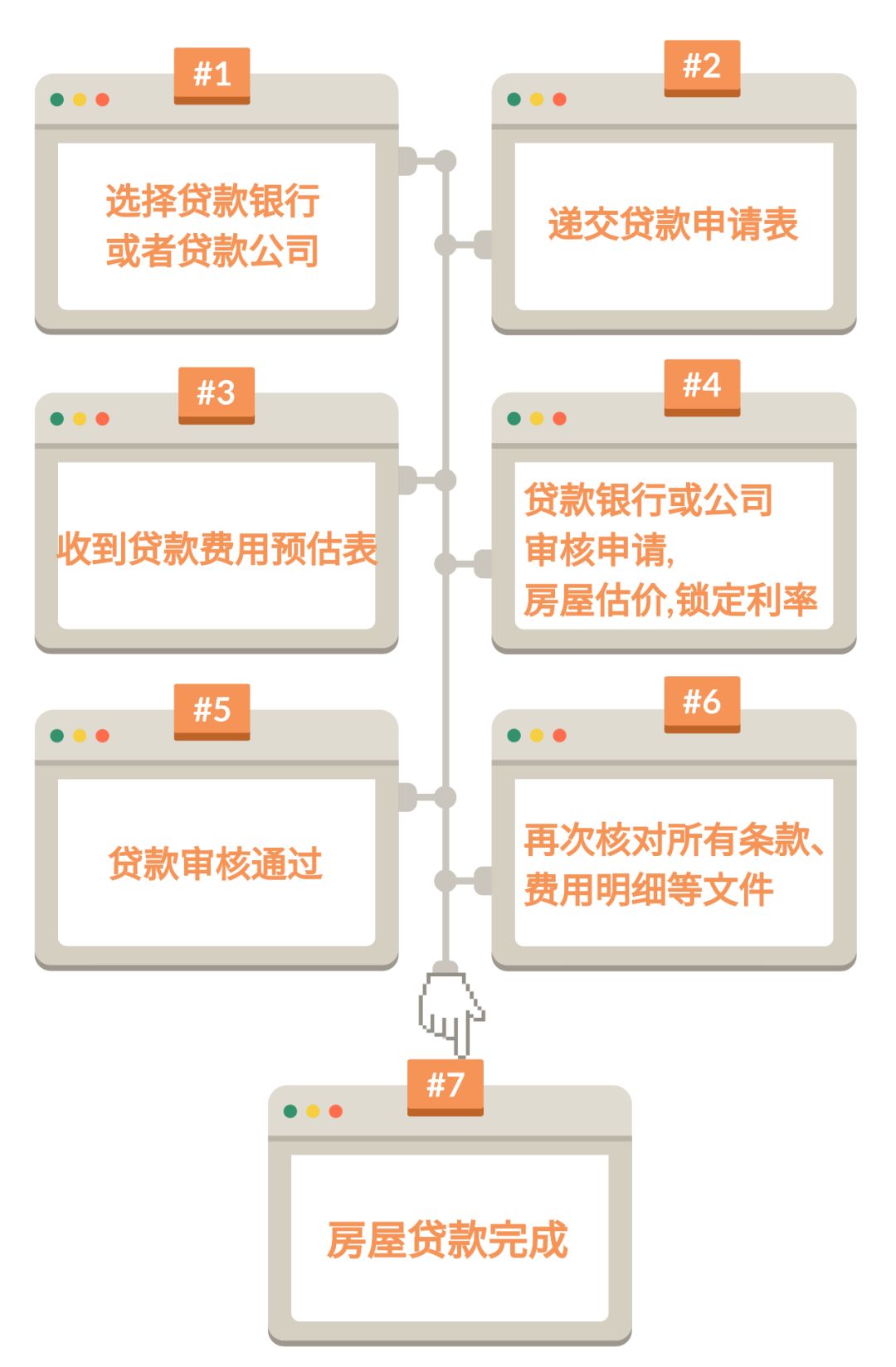

When it comes to securing a mortgage, many potential homebuyers find themselves overwhelmed by the myriad of options available. One of the most popular choices is the FHA loan, known for its accessibility and favorable terms. However, understanding the associated FHA loan charges is crucial for anyone considering this financing option. In this guide, we will delve into what these charges entail, how they can affect your overall loan costs, and tips for navigating them effectively.

What Are FHA Loan Charges?

FHA loan charges refer to the various fees and costs associated with obtaining a Federal Housing Administration (FHA) loan. These charges can include, but are not limited to, the following:

1. **Mortgage Insurance Premium (MIP)**: One of the most significant costs associated with FHA loans is the MIP. This insurance protects lenders in case of default and is required for all FHA loans. The MIP can be paid upfront at closing or rolled into the monthly mortgage payments.

2. **Origination Fees**: Lenders may charge an origination fee for processing your loan application. This fee typically ranges from 0.5% to 1% of the loan amount and can vary based on the lender's policies.

3. **Appraisal Fees**: Before approving your loan, the lender will require an appraisal to determine the home's value. This fee can vary based on the property's location and size but generally ranges from $300 to $700.

4. **Closing Costs**: These are the fees associated with finalizing the mortgage transaction, including title insurance, attorney fees, and recording fees. Closing costs can add up to 2% to 5% of the loan amount.

5. **Prepaid Costs**: These are expenses that need to be paid upfront, such as property taxes and homeowners insurance. Lenders may require you to prepay a portion of these costs at closing.

Why Understanding FHA Loan Charges Is Important

Being aware of FHA loan charges is essential for several reasons. First, it helps you budget effectively for your home purchase. Knowing the total costs associated with the loan can prevent unpleasant surprises at closing. Second, understanding these charges allows you to compare different lenders more accurately. Not all lenders will charge the same fees, so doing your research can save you significant amounts of money.

How to Minimize FHA Loan Charges

While some FHA loan charges are unavoidable, there are strategies to minimize them:

1. **Shop Around**: Different lenders offer various terms and fees. Take the time to compare offers from multiple lenders to find the best deal.

2. **Negotiate Fees**: Some fees, like origination fees, may be negotiable. Don’t hesitate to ask your lender if they can reduce these costs.

3. **Consider a Larger Down Payment**: If you can afford it, a larger down payment may reduce your MIP, thus lowering your overall FHA loan charges.

4. **Look for Grants or Assistance Programs**: Various local and state programs can help cover closing costs for first-time homebuyers. Research what’s available in your area.

5. **Review Your Loan Estimate**: Once you apply for a loan, your lender will provide a Loan Estimate document. Review this carefully to understand all the associated charges and ensure there are no surprises.

In summary, understanding FHA loan charges is a vital step in the home buying process. By familiarizing yourself with the various fees and costs associated with FHA loans, you can make informed decisions that align with your financial goals. Whether you are a first-time homebuyer or looking to refinance, being proactive about understanding these charges will empower you to navigate the mortgage landscape with confidence. Always remember to conduct thorough research, ask questions, and seek the best possible terms for your situation. Your dream home is within reach, and being informed is the first step toward achieving it!