Reert the Loan Recertify Process

Guide or Summary:Loan Recertify ReertWhat is Loan Recertify Reert?How Does Loan Recertify Reert Work?Why Choose Loan Recertify Reert?Loan Recertify ReertIn……

Guide or Summary:

- Loan Recertify Reert

- What is Loan Recertify Reert?

- How Does Loan Recertify Reert Work?

- Why Choose Loan Recertify Reert?

Loan Recertify Reert

In the ever-evolving financial landscape, securing a loan is no longer a straightforward task. It has become a complex process that requires meticulous planning and continuous monitoring. One such aspect of loan management that often goes unnoticed is the loan recertify process. This process involves verifying the borrower's eligibility and ensuring that the loan remains in good standing. Enter "Loan Recertify Reert," a cutting-edge solution designed to streamline and optimize this crucial process.

What is Loan Recertify Reert?

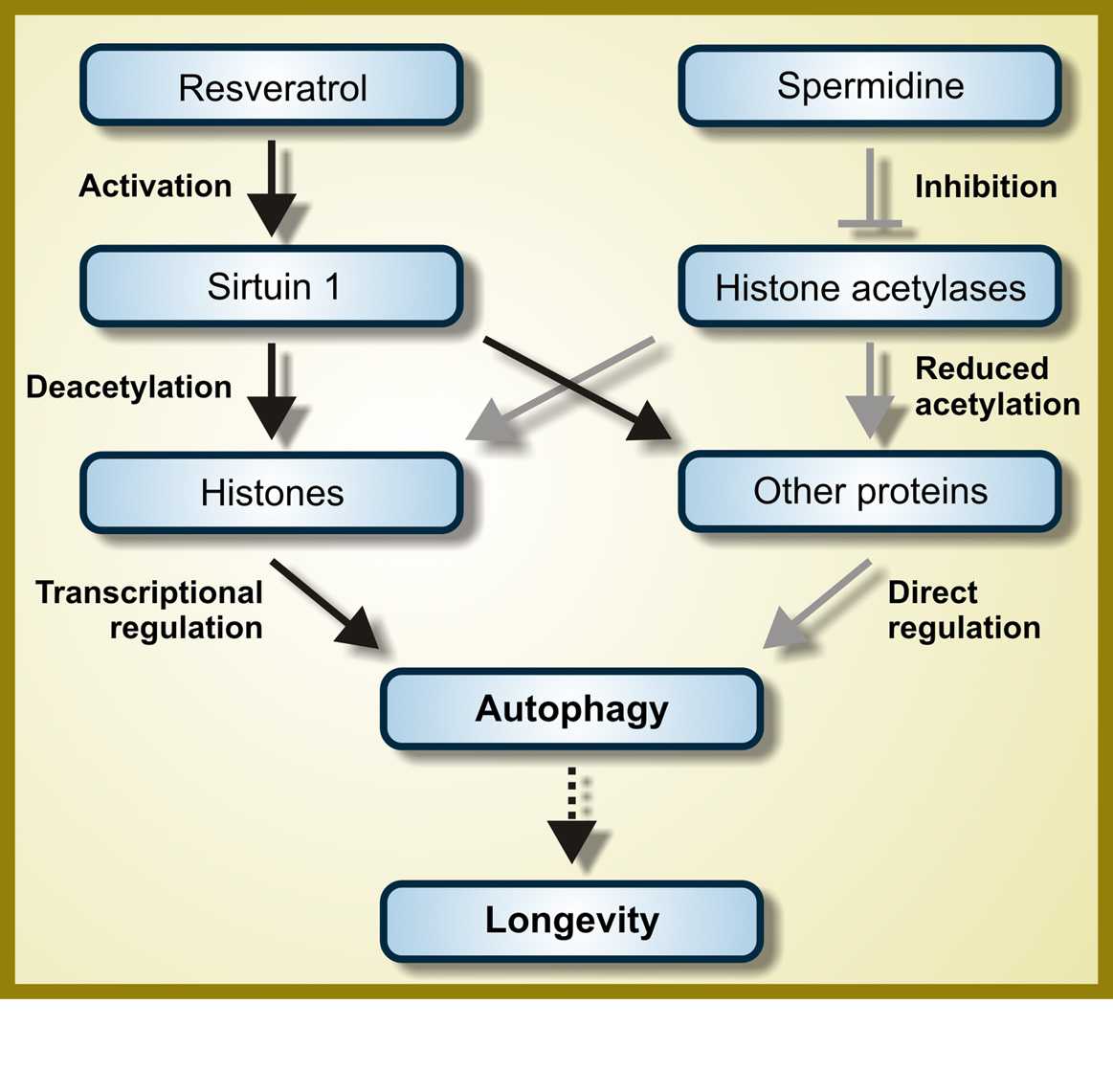

Loan Recertify Reert is a revolutionary approach to loan recertification. It leverages advanced technology and data analytics to automate the verification process, making it faster, more accurate, and more efficient. By integrating real-time data from various sources, Loan Recertify Reert ensures that borrowers' financial health is continuously monitored, providing lenders with peace of mind and borrowers with a seamless experience.

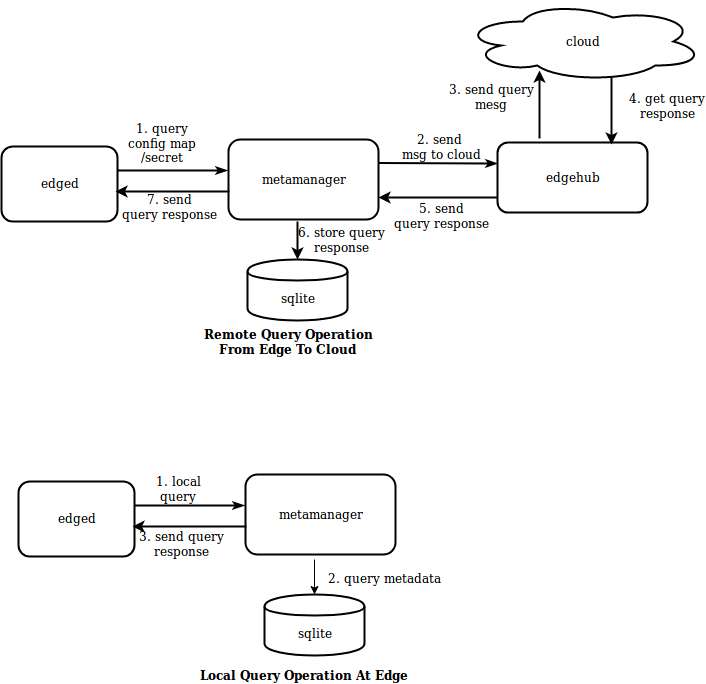

How Does Loan Recertify Reert Work?

The Loan Recertify Reert process begins with the collection of data from multiple sources, including credit reports, bank statements, and employment records. This data is then analyzed using sophisticated algorithms to assess the borrower's financial stability. If any red flags are detected, the system immediately flags the loan for further review, ensuring that potential risks are identified and addressed promptly.

One of the key benefits of Loan Recertify Reert is its ability to provide real-time updates. This means that lenders can stay informed about the borrower's financial status without the need for manual intervention. This not only saves time but also reduces the risk of errors or omissions in the recertification process.

Why Choose Loan Recertify Reert?

There are several compelling reasons to choose Loan Recertify Reert for your loan management needs:

1. **Efficiency**: With Loan Recertify Reert, the loan recertification process is automated, eliminating the need for manual intervention. This results in significant time savings and reduces the risk of human error.

2. **Accuracy**: The advanced algorithms used in Loan Recertify Reert ensure that borrowers' financial health is accurately assessed. This leads to more informed decision-making by lenders and a fairer assessment of borrowers' eligibility.

3. **Real-time Monitoring**: Loan Recertify Reert provides real-time updates on borrowers' financial status. This allows lenders to make informed decisions quickly and respond to any changes in the borrower's financial situation promptly.

4. **Compliance**: The loan recertify process is subject to stringent regulations. Loan Recertify Reert ensures compliance with these regulations by accurately verifying borrowers' eligibility and monitoring their financial status continuously.

5. **Customer Satisfaction**: By streamlining the loan recertification process, Loan Recertify Reert enhances the overall customer experience. Borrowers can rest assured that their financial health is being monitored continuously, while lenders can make informed decisions with confidence.

In conclusion, Loan Recertify Reert is a game-changer in the loan management industry. Its advanced technology and data analytics capabilities make it an invaluable tool for lenders and borrowers alike. By choosing Loan Recertify Reert, you can enjoy a faster, more accurate, and more efficient loan recertification process, leading to a smoother and more satisfying financial experience for everyone involved.