Calculator Home Loan Mortgage: Streamline Your Mortgage Choices with Precision

Guide or Summary:Understanding Mortgage OptionsCalculator Home Loan Mortgage: Your Personal Mortgage AdvisorStreamlining the Mortgage ProcessMaximizing Your……

Guide or Summary:

- Understanding Mortgage Options

- Calculator Home Loan Mortgage: Your Personal Mortgage Advisor

- Streamlining the Mortgage Process

- Maximizing Your Financial Potential

In today's bustling real estate market, the decision to purchase a home is not taken lightly. It's a significant financial commitment that requires careful planning, particularly when it comes to selecting the right mortgage. Enter the calculator home loan mortgage—a powerful tool designed to help you navigate the complexities of mortgage choices with precision and ease.

Understanding Mortgage Options

Before diving into the intricacies of the calculator home loan mortgage, let's first appreciate the importance of understanding mortgage options. Mortgages come in various forms, including fixed-rate, adjustable-rate, and interest-only loans. Each type has its own set of advantages and disadvantages, which can greatly impact your long-term financial health. It's crucial to weigh these options carefully to ensure you choose the mortgage that best suits your financial goals and risk tolerance.

Calculator Home Loan Mortgage: Your Personal Mortgage Advisor

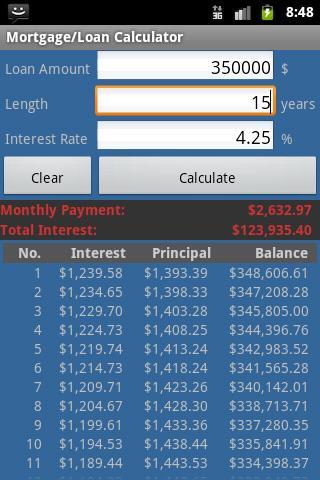

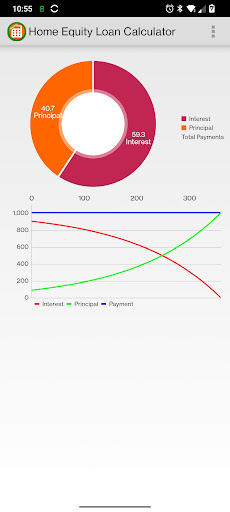

The calculator home loan mortgage serves as your personal mortgage advisor, offering a comprehensive analysis of different mortgage options based on your specific financial situation. By inputting your income, savings, and other relevant financial data, the calculator can provide you with tailored mortgage recommendations that align with your financial goals.

One of the most significant advantages of using a mortgage calculator is its ability to project future mortgage payments and the total amount of interest you'll pay over the life of the loan. This can be incredibly valuable in helping you make informed decisions about your mortgage, ensuring you choose a loan that fits within your budget and doesn't leave you financially strained.

Streamlining the Mortgage Process

The mortgage process can be daunting, with numerous forms to fill out, documentation to provide, and meetings to attend. However, the calculator home loan mortgage streamlines this process by providing you with a clear, concise overview of your mortgage options and the associated costs. This can save you valuable time and reduce the stress associated with navigating the complex world of mortgages.

In addition to simplifying the mortgage process, the calculator home loan mortgage also helps you stay informed about changes in the mortgage market. By regularly updating your financial data and mortgage options, you can make timely adjustments to your mortgage strategy, taking advantage of favorable market conditions and avoiding costly mistakes.

Maximizing Your Financial Potential

Ultimately, the goal of the calculator home loan mortgage is to help you maximize your financial potential while making informed decisions about your mortgage. By providing you with the tools and information you need to make these decisions, the calculator home loan mortgage empowers you to take control of your financial future.

In conclusion, the calculator home loan mortgage is a powerful tool that can help you navigate the complexities of the mortgage market with precision and confidence. Whether you're a first-time homebuyer or looking to refinance your existing mortgage, the calculator home loan mortgage can provide you with the insights and guidance you need to make informed decisions that align with your financial goals. So why wait? Start streamlining your mortgage choices today with the calculator home loan mortgage.