Understanding the Average Interest Rate on Home Loan: What Homebuyers Need to Know in 2023

Guide or Summary:Average Interest Rate on Home LoanWhat is the Average Interest Rate on Home Loan?Factors Influencing the Average Interest Rate on Home Loan……

Guide or Summary:

- Average Interest Rate on Home Loan

- What is the Average Interest Rate on Home Loan?

- Factors Influencing the Average Interest Rate on Home Loan

- Why Does the Average Interest Rate on Home Loan Matter?

- How to Find the Best Average Interest Rate on Home Loan

Average Interest Rate on Home Loan

The average interest rate on home loan is a crucial factor that can significantly influence a homebuyer’s decision-making process. In 2023, understanding this rate has become even more essential due to the fluctuating economic landscape and changing monetary policies. As potential homeowners navigate the complexities of the real estate market, they must be well-informed about how these interest rates can impact their overall financial health.

What is the Average Interest Rate on Home Loan?

The average interest rate on home loan refers to the typical cost of borrowing money to purchase a home, expressed as a percentage of the loan amount. This rate can vary based on several factors, including the borrower’s credit score, the type of loan, the length of the loan term, and current market conditions. In 2023, many lenders are offering competitive rates, but it’s essential for buyers to shop around and compare offers to secure the best deal possible.

Factors Influencing the Average Interest Rate on Home Loan

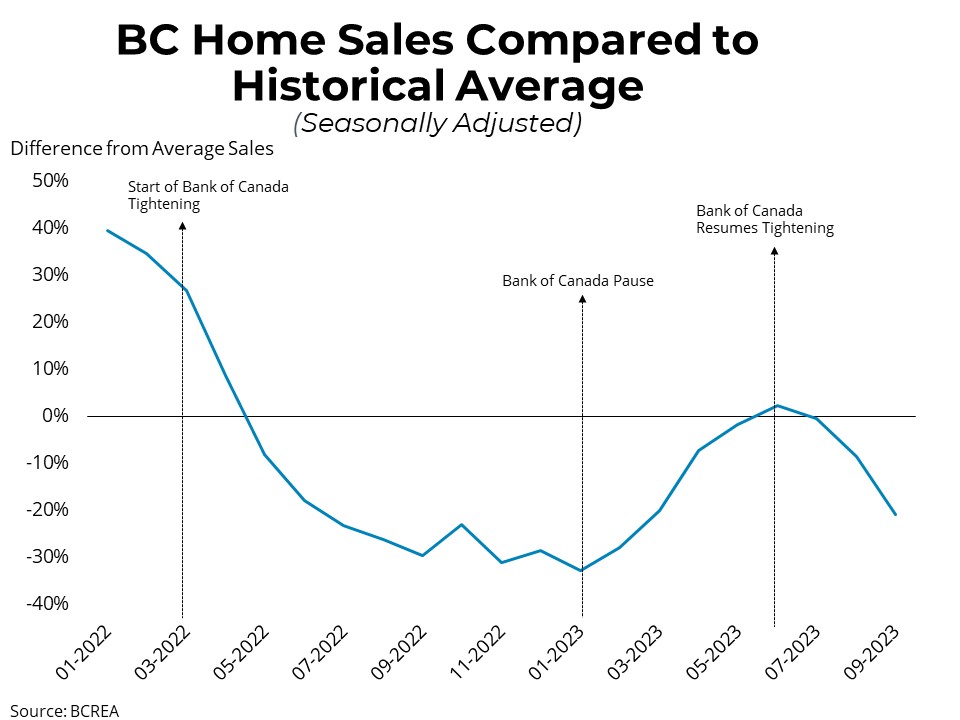

Several key factors influence the average interest rate on home loan. One of the most significant is the Federal Reserve's monetary policy, which dictates the overall economic environment. If the Fed raises interest rates to combat inflation, mortgage rates typically increase as well. Conversely, if the Fed lowers rates to stimulate the economy, mortgage rates may decrease.

Another critical factor is the borrower’s credit profile. Lenders assess creditworthiness through credit scores, which can affect the interest rate offered. Generally, borrowers with higher credit scores are eligible for lower interest rates, while those with lower scores may face higher rates. Additionally, the type of loan—whether it’s a conventional loan, FHA loan, or VA loan—can also impact the interest rate.

Why Does the Average Interest Rate on Home Loan Matter?

The average interest rate on home loan matters because it directly affects monthly mortgage payments and the total cost of the home over time. For instance, even a small difference in the interest rate can lead to significant savings or costs over the life of a loan. Homebuyers should consider how different rates will impact their budget and long-term financial goals.

Moreover, understanding the average interest rate on home loan can empower buyers to make informed decisions. By keeping an eye on market trends and rates, buyers can choose the right time to secure a mortgage, potentially saving thousands of dollars.

How to Find the Best Average Interest Rate on Home Loan

To find the best average interest rate on home loan, homebuyers should take several steps. First, it’s advisable to check credit scores and address any issues that may affect borrowing capacity. Next, potential buyers should research various lenders and their offerings, comparing rates and terms. Online mortgage calculators can also provide insights into how different rates will affect monthly payments.

Additionally, consulting with a mortgage broker can be beneficial. Brokers have access to multiple lenders and can help buyers navigate the mortgage landscape to find the best rates tailored to their specific needs.

In conclusion, the average interest rate on home loan is a vital component of the home buying process in 2023. By understanding the factors that influence these rates and actively seeking the best options, homebuyers can make more informed decisions that align with their financial goals. As the market continues to evolve, staying informed and proactive will be key to securing favorable mortgage terms.