"Can Anyone Get a Student Loan? Exploring Eligibility, Options, and Tips for Success"

#### Translation of "can anyone get a student loan":"Can anyone get a student loan?"---### Detailed Description:In today's educational landscape, the questi……

#### Translation of "can anyone get a student loan":

"Can anyone get a student loan?"

---

### Detailed Description:

In today's educational landscape, the question of **can anyone get a student loan** is becoming increasingly relevant. With rising tuition fees and the growing demand for higher education, many students are exploring their options for financial assistance. This article delves into the various aspects of student loans, including eligibility criteria, types of loans available, and practical tips for securing funding.

#### Understanding Eligibility

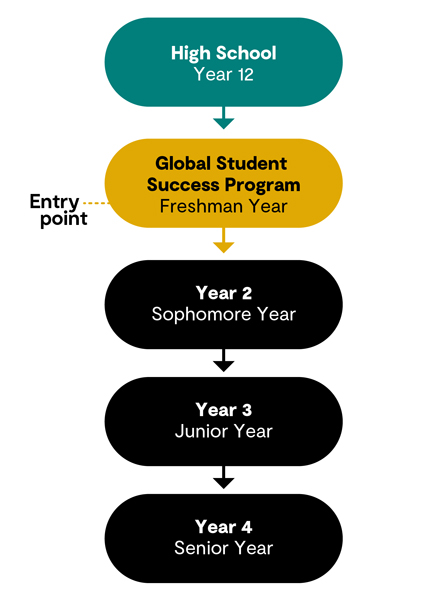

To determine **can anyone get a student loan**, it is essential to understand the eligibility criteria set by lenders and government programs. Generally, most student loans are available to U.S. citizens or eligible non-citizens who are enrolled at least half-time in an accredited institution. However, specific requirements can vary based on the type of loan.

For federal student loans, applicants must complete the Free Application for Federal Student Aid (FAFSA). This form assesses financial need and eligibility for federal aid programs. Factors such as income, family size, and the cost of attendance at the chosen school play a significant role in determining eligibility.

#### Types of Student Loans

When considering **can anyone get a student loan**, it’s important to know the different types of loans available. Federal student loans are often the most accessible and come with benefits such as fixed interest rates and flexible repayment options. The primary types include:

1. **Direct Subsidized Loans**: These loans are need-based and do not accrue interest while the borrower is in school at least half-time.

2. **Direct Unsubsidized Loans**: Available to all students regardless of financial need, interest begins accruing immediately.

3. **PLUS Loans**: These loans are for graduate students or parents of dependent undergraduate students and require a credit check.

In addition to federal loans, private loans are offered by banks and financial institutions. While they may cover the remaining costs not met by federal loans, they often come with variable interest rates and less favorable repayment terms.

#### Tips for Securing a Student Loan

If you’re wondering **can anyone get a student loan**, the answer is generally yes, but there are strategies to improve your chances of approval and minimize debt:

1. **Complete the FAFSA Early**: Submitting your FAFSA as soon as possible ensures you maximize your eligibility for federal aid.

2. **Research Scholarships and Grants**: Before taking on loans, explore scholarships and grants that do not require repayment. Many organizations offer financial assistance based on merit, need, or specific criteria.

3. **Maintain a Good Credit Score**: For private loans, a good credit score can significantly impact your interest rates. Pay off existing debts and manage your finances responsibly.

4. **Consider Loan Counseling**: Many schools offer financial counseling services that can help you understand your options and make informed decisions about borrowing.

5. **Understand Loan Terms**: Before accepting any loan, ensure you fully understand the terms, including interest rates, repayment schedules, and any potential fees.

#### Conclusion

In summary, the question of **can anyone get a student loan** is largely dependent on individual circumstances, including eligibility and financial need. By understanding the different types of loans available, the application process, and strategies for securing funding, students can navigate the financial landscape of higher education more effectively. With careful planning and informed decision-making, obtaining a student loan can be a viable option for many aspiring students.