Finding the Best Direct Loan Lender for Bad Credit: Your Ultimate Guide

Guide or Summary:Understanding Direct Loan Lenders for Bad CreditWhy Choose a Direct Loan Lender for Bad Credit?Types of Loans Offered by Direct LendersHow……

Guide or Summary:

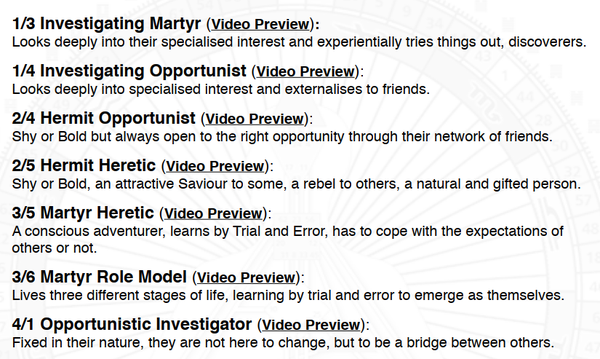

- Understanding Direct Loan Lenders for Bad Credit

- Why Choose a Direct Loan Lender for Bad Credit?

- Types of Loans Offered by Direct Lenders

- How to Choose the Right Direct Loan Lender for Bad Credit

**Translation of "direct loan lender for bad credit":** 直接贷款机构为信用不良者

---

Understanding Direct Loan Lenders for Bad Credit

In today's financial landscape, many individuals face challenges when it comes to obtaining loans due to poor credit scores. This is where a direct loan lender for bad credit becomes essential. These lenders specialize in offering loans to individuals who may not qualify for traditional financing options due to their credit history. Understanding how these lenders operate and what they can offer is crucial for those seeking financial assistance.

Why Choose a Direct Loan Lender for Bad Credit?

Choosing a direct loan lender for bad credit can provide several advantages. Firstly, these lenders often have more flexible criteria compared to traditional banks. They understand that credit scores do not always reflect a person's ability to repay a loan, and thus, they may consider other factors such as income and employment history. This flexibility can make it easier for borrowers to secure the funds they need.

Additionally, working with a direct loan lender for bad credit can streamline the loan process. Unlike brokers who may charge fees or take a commission, direct lenders deal directly with borrowers, which can lead to quicker approvals and disbursements. This is particularly beneficial for those who require immediate financial assistance.

Types of Loans Offered by Direct Lenders

Direct loan lenders for bad credit typically offer a variety of loan types to cater to different needs. Some common options include:

1. **Personal Loans**: These unsecured loans can be used for various purposes, such as consolidating debt, covering medical expenses, or funding home improvements.

2. **Payday Loans**: Short-term loans designed to cover urgent expenses until the borrower's next payday. However, these often come with high-interest rates, so caution is advised.

3. **Installment Loans**: These loans allow borrowers to repay the borrowed amount in fixed monthly installments, making them more manageable for those with tight budgets.

4. **Title Loans**: Secured loans where the borrower uses their vehicle title as collateral. This option can be useful for those who own a car but have bad credit.

How to Choose the Right Direct Loan Lender for Bad Credit

When searching for a direct loan lender for bad credit, it’s essential to consider several factors:

- **Reputation**: Research the lender's background and read reviews from previous borrowers. A reputable lender will have positive feedback and transparent practices.

- **Interest Rates and Fees**: Compare the interest rates and any associated fees from different lenders. This will help you find a loan that fits within your budget.

- **Loan Terms**: Understand the repayment terms, including the loan duration and monthly payment amounts. Make sure you can comfortably meet these obligations.

- **Customer Service**: A lender that offers good customer support can make the borrowing process smoother. Look for lenders that are responsive and helpful.

- **Approval Process**: Consider how quickly the lender can approve your application and disburse funds. If you need money urgently, a lender with a fast approval process is ideal.

Securing a loan with bad credit may seem daunting, but with the right direct loan lender for bad credit, it is entirely possible. By understanding your options and taking the time to choose a reputable lender, you can find a financial solution that meets your needs. Whether you need a personal loan, a payday loan, or another type of financing, there are direct lenders ready to assist you on your path to financial recovery. Remember to carefully evaluate your choices and make informed decisions to ensure a positive borrowing experience.