Understanding Home Equity Loan Rates in Florida: What You Need to Know

#### Home Equity Loan Rates FloridaWhen considering a home equity loan in Florida, it's essential to understand the current home equity loan rates Florida h……

#### Home Equity Loan Rates Florida

When considering a home equity loan in Florida, it's essential to understand the current home equity loan rates Florida has to offer. Home equity loans allow homeowners to borrow against the equity they have built in their property, providing a lump sum of cash that can be used for various purposes, such as home renovations, debt consolidation, or major purchases. The interest rates on these loans can vary significantly based on several factors, including the lender, the borrower's credit score, and the overall economic climate.

#### Factors Influencing Home Equity Loan Rates

Several factors influence the home equity loan rates Florida residents may encounter. First and foremost is the borrower's credit score. Lenders typically offer better rates to those with higher credit scores, as they are seen as less risky. If your credit score is below average, you may still qualify for a home equity loan, but expect to pay a higher interest rate.

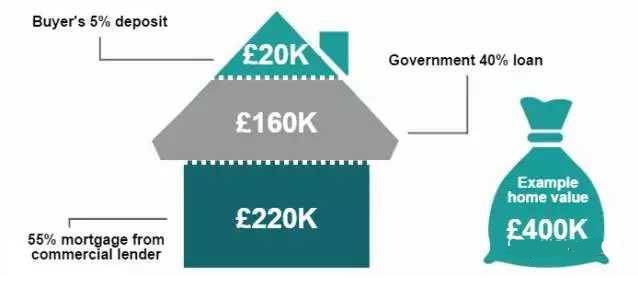

Another critical factor is the loan-to-value (LTV) ratio. This ratio compares the amount of the loan to the appraised value of the home. Lenders generally prefer a lower LTV ratio, which indicates that the borrower has a significant amount of equity in their home. A lower LTV can lead to better loan terms and lower interest rates.

The overall economic environment also plays a significant role in determining home equity loan rates. When the Federal Reserve raises interest rates to combat inflation, lenders often follow suit, resulting in higher rates for borrowers. Conversely, when rates are low, homeowners may find more favorable terms.

#### Current Trends in Home Equity Loan Rates in Florida

As of late 2023, the home equity loan rates in Florida have shown some fluctuations due to varying economic conditions. Homeowners are encouraged to shop around and compare rates from different lenders to find the best deal. Online tools and calculators can help you estimate potential payments and understand how different rates will impact your overall financial situation.

Additionally, many financial institutions in Florida offer promotional rates for home equity loans, particularly for new customers or those who meet specific criteria. It’s essential to read the fine print and understand any fees or conditions attached to these promotional rates.

#### Benefits of Home Equity Loans

Home equity loans can be an excellent financial tool for homeowners looking to leverage their property’s value. One of the primary benefits is the relatively low-interest rates compared to unsecured loans or credit cards. Since the loan is secured by the home, lenders are more willing to offer lower rates.

Another advantage is the potential tax benefits. In some cases, the interest paid on a home equity loan may be tax-deductible, particularly if the funds are used for home improvements. Homeowners should consult with a tax professional to understand their specific situation.

#### Conclusion

In summary, understanding home equity loan rates in Florida is crucial for homeowners considering this financial option. By keeping an eye on current rates, understanding the factors that influence them, and evaluating the benefits, you can make informed decisions that align with your financial goals. Whether you're looking to renovate your home, consolidate debt, or finance a major purchase, a home equity loan could be a viable solution, provided you do your research and choose the right lender.